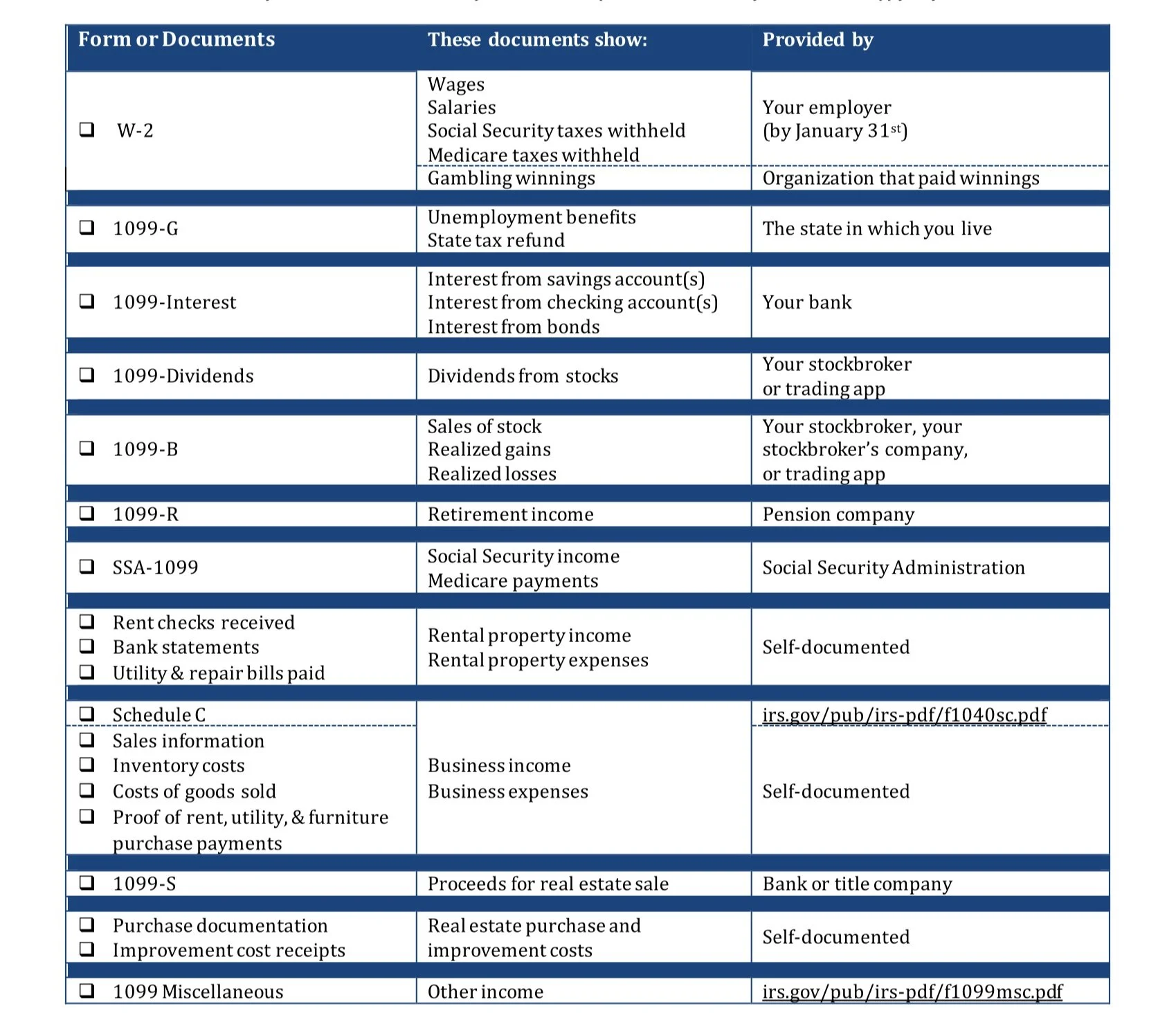

Be Prepared: Common Income-Related Tax Documents

/DISCLAIMER: These articles are based on the tax requirements for 2020. Tax requirements change frequently so future requirements may be different. This article and future articles on this subject are not tax advice, they are meant to help you to know what documentation to prepare when submitting your information to your tax preparer. Always check with your tax preparer for the proper documentation required for that year and for any specific tax advice.

Be Prepared (Part 7)

Common Income-Related Tax Documents

As the title suggests, being prepared to do your taxes is important as it can save you time. It can also save you money. The organized documentation you give to your tax preparer, even if it you do your own taxes will make the work go faster and it will enable the correct calculation of your tax or refund. No sense paying too much or getting a smaller refund than you deserve.

Common Documents Needed for Preparing Your Taxes

It’s important to know what documents to gather and have ready as we get closer to the deadline to submit taxes for last year. You will need forms related to income, which will show money earned throughout the fiscal (tax) year. You will also need forms that show deductions for money spent during the past calendar year.

Here, we will break down what you will need, related to income, when preparing to file your taxes for last year. Below is a basic list you can use to check that you have the common documents you need in order to prepare your taxes. You may need additional documents for each list. Not every document may apply to you.

Common Income-related forms

Wages and Salaries

If you are employed, the company you work for should send you a W-2 form for the previous year by January 31st of the following year. The W-2 lists your wages, Social Security and Medicare taxes withheld for the year.

Documentation needed: Form W-2

Unemployment Benefits and State tax refunds

The state should send you this form, which lists unemployment benefits, and a separate 1099-G if you received a state tax refund. Both the benefits and the tax refund may be taxable.

Documentation needed: Form 1099-G

Interest and Dividends

There are two forms which report any interest you have received from savings accounts, checking accounts, or bonds, and any dividends you may have received from stocks. The bank will send you a 1099-Interest form. Your stockbroker will send you the 1099-Dividends form. If you use a stock trading app without going through a stockbroker, you should receive these forms from them.

Documentation needed: 1099-Interest form, 1099-Dividends form

Broker Statement

If you have a stockbroker, they or their company will send you a 1099-B form. The 1099-B lists all your sales of stock, and any realized gains or losses from those sales during the given tax year. A gain is realized when an asset is sold for more than you paid for it; a loss is realized when you sell an asset at a lower price than you paid for it.

Documentation needed: 1099-B form

Retirement Income

If you are retired, the pension company will send you a 1099-R form. The 1099-R lists all your retirement income for the given tax year.

Documentation needed: 1099-R form

Social Security

The Social Security Administration (SSA) will send you a SSA-1099 form. This form lists all your social security income and Medicare payments made during the year.

Documentation needed: SSA-1099 form

Rental Income from property you own

If you own property that you rent out, you will need to prepare the income and expenses from those rental properties.

Documentation needed:

Rent checks received

Bank Statements

Utility Bills (if you pay the utilities at that property, like water and garbage)

Repair bills

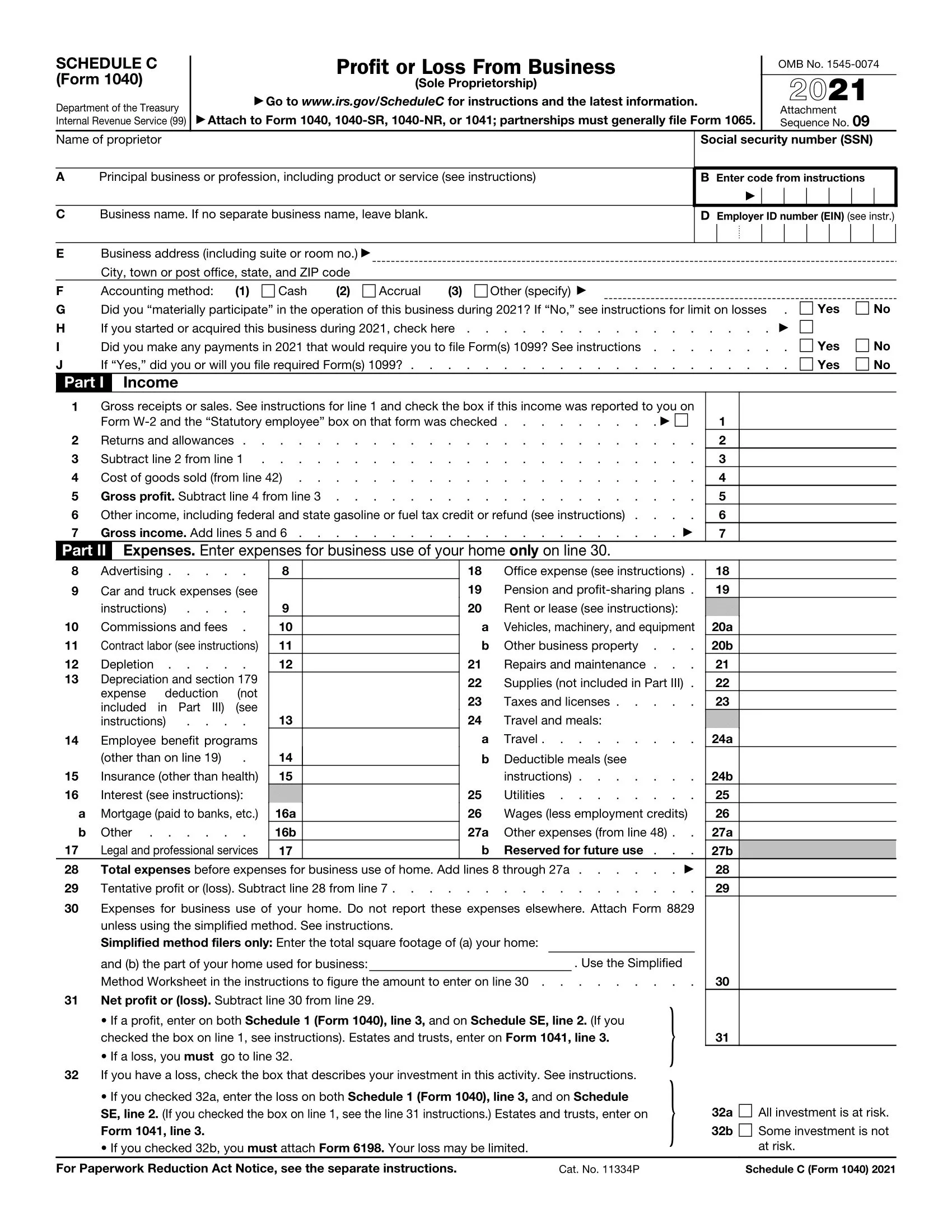

Business Income and expenses

If you own a business, you will need to prepare the income and expenses from your business. Your tax preparer will prepare a form, called the Schedule C, for your business. This form lists all the income and expenses of your business that you provide to him.

Documentation needed:

Schedule C form (to be prepared)

Sales information

Inventory cost related to sales

Cost of goods sold

Proof of rent, utility, & furniture purchase payments

Gambling winnings

If you have winnings from events such as horse and dog racing, lotteries, or bingo, you should receive a W-2 form from the appropriate organization from which you won the money. Winnings from recreational gambling, such as gambling between friends, is not reported. If you or someone you know has a gambling problem, call the National Council on Problem Gambling at 1-800-522-4700.

Documentation needed: Form W-2

Sale of Real Estate Property

If you sell your home or other real estate, you own you should receive a 1099-S form from the bank or title company. The 1099-S will list the proceeds for the sale. You will need to have documents that show the original price. You will also need documentation for any improvements you made to the during the time you lived there.

Gain/Loss = Sales Price - (Purchase Cost + Improvement Costs)

The gain or loss on the sale of a property equals the Sales Price minus the cost, plus the cost of any improvements made. A gain may be taxable; a loss will be tax deductible depending on the amount of appreciation. Appreciation is the amount of the increase in value, compared to the amounts paid for the purchase of, and improvements to that property. Your tax preparer will calculate the tax.

Documentation needed:

1099-S

Purchase documentation

Improvement cost receipts

Miscellaneous

The 1099 Miscellaneous form covers other income you may receive. This includes, for example, if you are self-employed, or have any prize winnings.

Documentation needed: Form 1099 Miscellaneous

Stay tuned for Part 8 of our “Be Prepared” series, where we will share another useful checklist you can use when preparing to file your taxes.

© Whatismyhealth

Special acknowledgements to TurboTax and the National Council on Problem Gambling, and our reference:

A checklist of common documents related to deductions and credits that you will need when preparing to file your taxes for last year.